by taxPRO Websites Staff | Mar 14, 2023 | Tax Tips and News

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court ruled that the penalty for nonwillful failure to file an FBAR should be assessed on a per-report basis—capping fines at $10,000 per year, regardless of the number of accounts.… Read more about SCOTUS Rules FBAR Penalty Determined on Per-Report Basis (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Mar 10, 2023 | Tax Tips and News

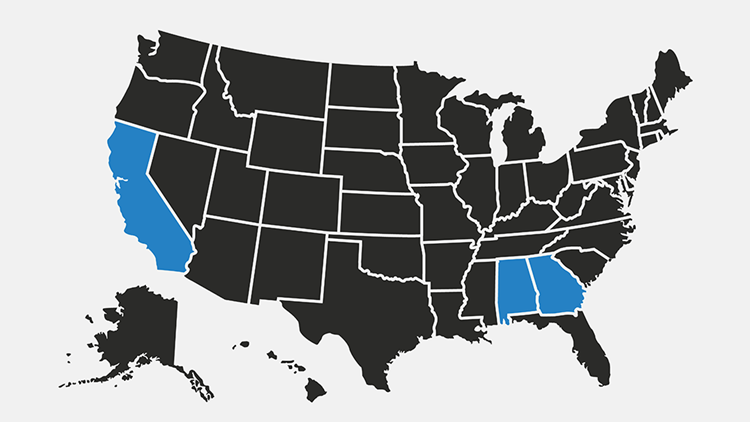

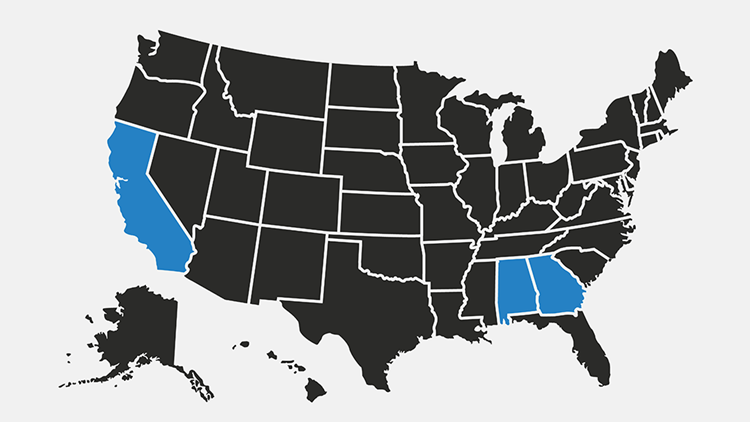

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines.… Read more about Tax Relief Extended for Disaster Victims in Alabama, California, and Georgia (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Mar 9, 2023 | Tax Tips and News

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file an FBAR should be assessed on a per-report basis—capping fines at $10,000 per year, regardless of the number of accounts.… Read more about SCOTUS Holds FBAR Penalty Determined on Per-Report Basis (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Feb 21, 2023 | Tax Tips and News

Filing an amended return used to mean completing a paper form, regardless of how taxpayers submitted the original return to the Internal Revenue Service. During the pandemic, paper-filed returns… Read more about IRS Announces Direct Deposit for Amended Returns (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Feb 18, 2023 | Tax Tips and News

In 2022, millions of Americans received special state-issued payments designed to provide economic relief to residents struggling with financial burdens exacerbated by issues ranging from the pandemic to natural disasters. One week after urging recipients to postpone filing their returns, the Internal Revenue Service has issued official guidance regarding the federal taxability of those payments.… Read more about 2022 Special State Payments Not Taxable (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Feb 15, 2023 | Tax Tips and News

As part of the Inflation Reduction Act of 2022, lawmakers made changes to the Clean Vehicle Credit that were meant to encourage the purchase of U.S.-made electric and fuel cell vehicles. Unfortunately, the criteria for qualifying vehicles has proven confusing for some taxpayers.… Read more about Clean Vehicle Credit Guidance Revises Classifications (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…